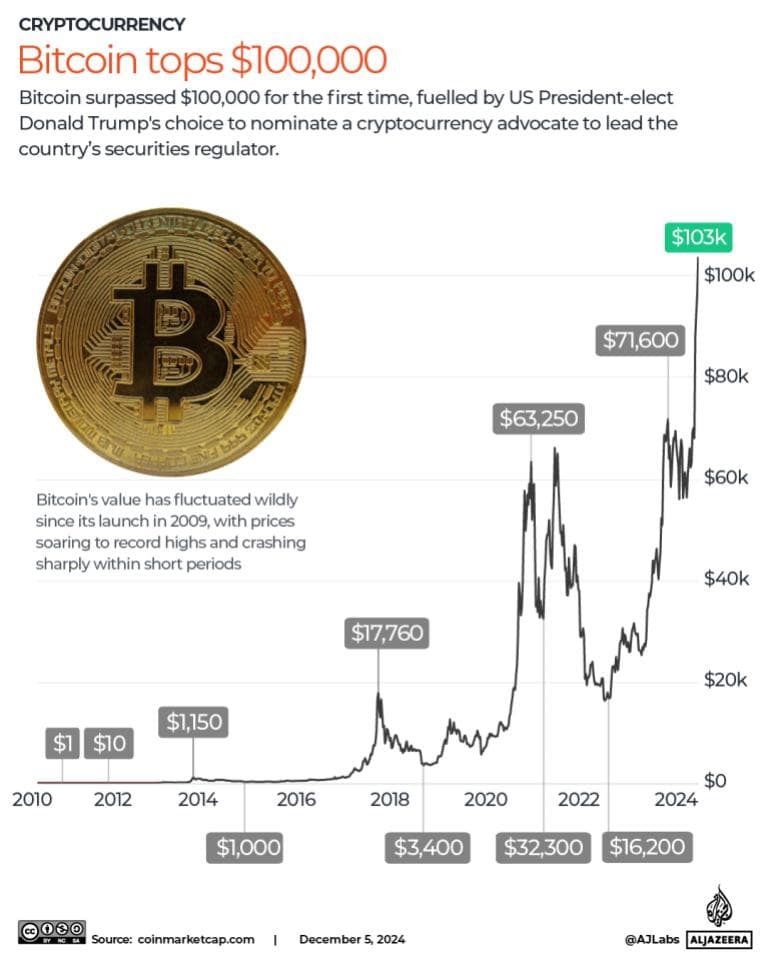

Bitcoin Surpasses $100k: No More Excuses, Here’s What’s Really Going On

So, Bitcoin just broke the $100,000 mark. Yeah, you read that right.

For the first time, Bitcoin has surged past $100k, and every crypto enthusiast, armchair expert, and financial commentator is suddenly acting like they just discovered fire. But here’s the thing: this milestone didn’t just fall out of the sky.

It didn’t happen because of some miracle or cosmic alignment. There are real reasons, factors, and players behind this, and we’re going to cut through the noise and lay it out for you without the fluff.

Bitcoin’s rise isn't about the hype, it’s about what’s driving this madness and why the market is reacting the way it is. So, let’s get real.

1. Bitcoin’s Historic Surge Past $100k

Alright, let’s start with the obvious. Bitcoin just shattered the $100k threshold. This isn’t just a random price bump; it’s a milestone that has people up in arms, acting like this is the first time anyone has ever made money on crypto.

Seriously, it’s a huge deal, but it’s not like Bitcoin’s first rodeo. The thing has been climbing for years, but this? This is different.

For context, let’s rewind a bit. Back in 2021, Bitcoin briefly touched $69,000 before falling into the familiar, soul-crushing crash we all know too well. But this time? It’s holding steady.

As of today, Bitcoin has broken past $100k, a psychological and financial barrier that has experts clutching their pearls and calling for even bigger gains. But why?

We’ll get into that.

2. Key Drivers Behind Bitcoin’s Surge

This isn’t just some "random surge" driven by a few retail investors with too much time on their hands. No, this is a calculated climb, pushed by some very real, very important factors. So, let's break them down:

Regulatory Optimism

Bitcoin’s surge is not just fueled by a bunch of people buying in because they think "it’s going up." Nope, it’s about what’s happening in the regulatory space, or more specifically, what might happen.

Here’s the deal: Bitcoin’s latest rally is being fueled by optimism around the new SEC nominee in the U.S.

The possibility that the new SEC leadership will be more favorable to crypto regulations is enough to send markets into a frenzy.

Why? Because clear regulatory guidelines are one of the biggest barriers for institutional investors. Without them, crypto is seen as the Wild West, and no one wants to get burned by the next "pump and dump" scheme.

If the SEC comes through with more favorable regulations, Bitcoin could see an even bigger influx of institutional investors, and that’s what the market is betting on right now.

Institutional Adoption

This is the big one. This isn’t some digital currency for Reddit nerds anymore. We’re talking hedge funds, multi-billion-dollar companies, and even governments starting to put serious cash into Bitcoin.

The likes of MicroStrategy, Tesla, and Grayscale aren’t exactly small players, and they’ve made their positions clear: Bitcoin isn’t just a "maybe" anymore; it’s a serious asset class.

If you think about it, Bitcoin is becoming part of the mainstream portfolio of investment assets, right alongside stocks, bonds, and gold. The shift from skeptical naysayers to all-in believers is real, and it’s driving demand through the roof.

Read about experts reaction to Bitcoin marking $100k

Inflation Hedge and Economic Uncertainty

Do we need to even mention the state of the global economy? Inflation’s out of control. Central banks are printing money like it’s their job. Traditional assets are being devalued, and everyone’s looking for an alternative. Enter Bitcoin.

Bitcoin is being hailed as a haven, a store of value, much like gold. Investors are flocking to it, not just because they think it’s "cool," but because it’s seen as a hedge against inflation.

And let’s face it, when the traditional financial system is playing fast and loose, people are looking for anything that’s not tied to the same broken system.

Technological Advancements

Yeah, we know. "Crypto is slow. It’s inefficient. It’s not scalable." Keep telling yourself that while Bitcoin continues to outperform every other asset class.

Bitcoin’s technological advancements, such as the Lightning Network, are making it more viable for large-scale use.

Transactions are faster, cheaper, and more efficient than they’ve ever been. Don’t believe the critics who say Bitcoin’s tech is lagging, the network is evolving, and it’s evolving fast.

If you're still pretending Bitcoin is just some experiment, it’s time to wake up.

Bitcoin crossing $100k , what's next?

3. Investor Reactions and Sentiment

Now, let's talk about the people who are actually behind this price surge: the investors. We’re talking about two groups here: retail investors and institutional players. Here’s the kicker – both groups are reacting in a way that’s feeding into this madness.

Retail Investor Frenzy

Let’s be honest. Retail investors are the ones who push the price up. Every time Bitcoin surges, you get the usual suspects jumping in, buying the dip, and trying to catch the next big wave. There’s a lot of excitement in the air, and with good reason, Bitcoin is performing like an absolute beast.

But here’s the problem: retail investors are also the ones who get wrecked the hardest when things go south.

And trust me, Bitcoin has a history of crashing when you least expect it. So, while it’s nice to see people getting rich, let’s not forget that most of these people are betting their life savings on something that could drop 30% overnight.

Institutional Confidence

Now, the institutional players? They’re a bit more calculated. They're here for the long haul. They’re not flipping Bitcoin for a quick buck. They’re treating it like a serious asset.

Institutions see Bitcoin as a portfolio diversifier, a way to hedge against traditional market risks. But make no mistake, their confidence is real, and their money is big.

They’re betting that Bitcoin’s rise is sustainable. And when they start putting millions (or even billions) into it, the price moves accordingly.

The FOMO Effect

Here's the dirty little secret: FOMO (fear of missing out) is a real thing. Every time Bitcoin breaks a new record, the crowd gets louder. More retail investors jump in. More institutional funds flood the market. The cycle continues. And as Bitcoin rises, so does the sense that you’re "missing out" on something huge.

But here’s the reality: chasing that FOMO could lead to disaster. You’re buying into an inherently volatile market, where prices can swing wildly. Remember, this isn’t the stock market – it’s the crypto jungle.

4. Bitcoin’s Impact on the Broader Financial Market

Bitcoin isn’t just some isolated experiment anymore. It’s influencing the entire financial system, and that’s not an exaggeration.

Traditional Markets

Bitcoin is no longer a niche investment; it’s a mainstream asset class. Traditional investors are taking it seriously now, whether they like it or not.

The rise of Bitcoin is reshaping how financial markets think about digital assets, and that’s a huge shift.

Global Payment Systems

With Bitcoin’s increasing adoption, it’s becoming more than just a "store of value." Bitcoin is now a legitimate player in global payments.

More merchants are accepting it as payment, more institutions are building on it, and more governments are looking at it like they need to keep up. The world is slowly but surely shifting toward decentralized finance.

Policy Implications

Governments are starting to take note, and that means policy changes are coming. Some countries are already talking about creating central bank digital currencies (CBDCs), which could either complement or challenge Bitcoin. There’s no denying it: Bitcoin is forcing governments to rethink their monetary policies.

5. Future Projections for Bitcoin

Let’s cut to the chase: where is Bitcoin going from here?

Analysts’ Predictions

Some analysts are calling for Bitcoin to hit $120k, $150k, or even higher. With institutions piling in, and more people treating it like a legitimate asset class, the sky’s the limit.

Or maybe it’s not , who knows? Crypto’s volatile nature means it could crash as quickly as it rises.

Potential Roadblocks

Bitcoin’s not invincible. A sudden crackdown by governments, a catastrophic technological flaw, or even a massive security breach could knock the wind out of its sails. Don’t get too comfortable.

Sustaining the Bull Market

The big question: Can Bitcoin keep going up? Maybe. Maybe not. The truth is, no one really knows. But with more institutional backing and a growing belief that it’s here to stay, there’s a chance we could see Bitcoin sustain this rally longer than expected.

Conclusion

So here we are. Bitcoin’s at $100k. It’s a big deal, but it’s not a fluke. There are real drivers behind this surge, and it’s not just about speculators betting on the next big thing.

But let’s not kid ourselves, this is a volatile market, and what goes up can come down just as fast.

Will Bitcoin hold steady, or will we be watching a massive crash shortly? That remains to be seen. But one thing’s for sure: the game has changed. And if you’re not paying attention, you’re going to miss the boat.